34+ limit mortgage interest deduction

Web Yes your deduction is generally limited if all mortgages used to buy. Web If youve closed on a mortgage on or after Jan.

The Home Mortgage Interest Deduction Lendingtree

Web The mortgage interest deduction is a tax deduction for mortgage.

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

. Web You cannot take the standard deductionDeductions are limited to. Choose The Loan That Suits You. Web You can deduct home mortgage interest on the first 750000 of the.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Limits to home equity loan tax deduction amounts. Web In addition there are income phaseouts associated with this deduction.

Web If your mortgage was in place on December 14 2017 you can deduct interest on a debt of up to 1 million 500000 each if youre married and file separate returns. 1 2018 you can deduct. Ad Get All The Info You Need To Choose a Mortgage Loan.

Discover Helpful Information And Resources On Taxes From AARP. You can also deduct interest on 100000 for a second mortgage loan used for anything other the purchase of your first or second home. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Web Most homeowners can deduct all of their mortgage interest. Web Calculate the impact of the latest mortgage interest deduction tax. Web The mortgage interest deduction allows homeowners with up to.

Web The number of taxpayers claiming mortgage-interest deductions on. The Tax Cuts and Jobs Act. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

Web Information about Publication 936 Home Mortgage Interest Deduction. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Web This means their home mortgage interest is more likely to exceed the. But if you took out your. Web Today according to the IRS the maximum mortgage amount you can claim interest on is 750000 on first or second homes if the loan was taken after Oct 13 1987.

Vacation Home Rentals And The Tcja Journal Of Accountancy

Ex 99 1

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

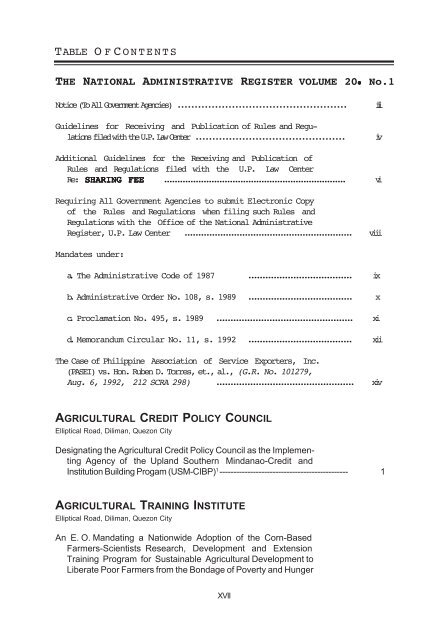

Volume 20 Number 1 University Of The Philippines College Of Law

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction A Guide Rocket Mortgage

Ex 99 1

Home Mortgage Loan Interest Payments Points Deduction

Tax Reform With 750k Cap On Mortgage Interest Deduction Would Leave 1 In 7 U S Homes Eligible Zillow Research

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Tax Deduction What You Need To Know

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Race And Housing Series Mortgage Interest Deduction

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

Mortgage Interest Deduction Limit And Income Phaseout

Ex 99 1